With their increased prominence at the recent G20 meeting, the dominant narrative around China and India as the success stories of globalisation certainly has a ring of truth. However, in an expansive IDS Annual Lecture at the University of Sussex, Professor Jayati Ghosh from Jawaharlal Nehru University, New Delhi, highlighted the need to look beyond just their impressive economic growth. The complexities and challenges under the surface paint a more nuanced picture. IDS student Sam Sharp summarises.

‘IDS Annual Lecture 2017,’ IDS, Creative Commons Attribution licence (reuse allowed)

The superficial similarities of ‘Chindia’

Ghosh is not a fan of the ‘horrible term Chindia’, which lumps together the two countries due to their rapid Gross Domestic Product (GDP) growth and geographic proximity. The similarities between the countries are ‘quite superficial’ however, and the differences crucial. Most obviously China is a one-party state and was predominantly a command economy, compared to India’s ‘essentially capitalist economy’ and multi-party democracy.

Moreover, the extent of their GDP growth is not comparable: China sustained growth over 8% for three decades and has ‘historically unprecedented’ levels of investment. On the other hand, India’s stratospheric growth is more recent and investment as a proportion of GDP remains stubbornly around the developing country average. India’s growth is also less export-led; the narrative of India as the ‘global office’ to China’s ‘global factory’ doesn’t hold up.

Indian growth without diversification

China has roughly followed the ‘classic pattern’ of economic growth and structural change, moving from the primary sector to manufacturing to services. Conversely, India’s has followed ‘a peculiar pattern not found in any other economy’. There has been a very limited change in Indian primary sector employment, while the primary sector’s share of total output has declined. Growth has not brought a substantial increase in manufacturing employment. In sum, most of the workforce remains stuck in low productivity agricultural work.

This lack of diversification, Ghosh asserts, is the underlying basis of India’s other problems. She summarises: ‘it may be excessively economic determinist, but if you cannot move people out of low productivity activities, the aggregate workforce is not going to be better off’. Even with India’s generous description of formal employment as any job with a formal contract or paid leave or social security, it still accounts for only 4% of the workforce.

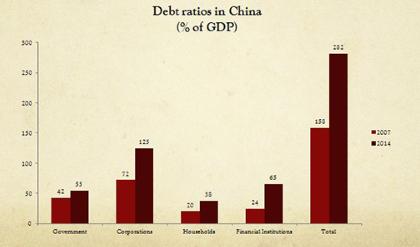

Economy wide indebtedness

China relied on a ‘debt financed boom’ to get out of the global financial crisis. As a result Chinese indebtedness has almost tripled, and as a percentage of GDP is now over 280%. As the below figure shows, this indebtedness is spread across the whole economy, from provincial governments to households. Both investment and debt accumulation are showing diminishing returns in terms of GDP growth, what Ghosh describes as ‘a sure sign of a bubble’. India also faces an indebtedness problem: its recent high levels of growth have been based on the state pushing commercial banks to make long term investments. These commercial banks are now saddled with this ‘bad debt’ and unwilling to invest more, leaving India needing to find a new growth path.

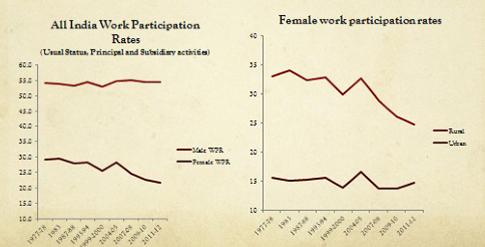

Gender inequality

China and India have both seen declining women’s labour force participation. Only a few countries globally have experienced this over the last two decades, and it is ‘unheard of in a period where GDP is growing so rapidly’. In China, Ghosh notices a rising social pressure for women to be part of a patriarchal system and dependent on their husband’s income. In India, Ghosh’s data shows a shift for women to working not just in the care economy, but also in ‘domestic duties’ such as collecting firewood. When this unpaid labour is accounted for the female work participation rate is 85% not the official 24%. Overall this shift from paid to unpaid domestic labour is ‘effectively a huge subsidy on the recognised economy’.

The environmental cost of growth

For China and India the environmental costs of rapid growth are not just a problem for the distant future, but current and real. Combined they account for more than half of global deaths due to air pollution. Both countries also suffer substantial issues with water quality and availability. In China this manifests in around 50,000 protests a year related to water degradation. Interestingly, these environmental problems are not just restricted to urban areas but are often worse in small towns and peri-urban areas.

So what can be done? Fundamentally Ghosh advocates for a shift from a ‘trickle down strategy’ that privileges GDP growth over quality of life to a ‘bubble-up strategy’. More tangibly on how to achieve this, she suggests a focus on universal public service provision, with the state an ‘employer of last resort’ of good quality jobs. Additionally, she encourages a rebalancing of strategic focus towards micro to medium enterprises, and away from just large corporations.