At the UN’s Financing for Development (FfD4) conference in Spain, strengthening taxation was a crucial topic.

With aid budgets in decline and a deepening debt crisis, investment in strengthened tax systems in lower-income countries is essential to raise revenue fairly and sustainably.

Tax has already overtaken aid as the largest source of development finance. Yet with many lower-income countries collecting less than 15% of GDP in tax – a fraction of what wealthier countries raise – much more needs to be done.

At FfD4, how did action on donor commitments and international tax cooperation square up with the pre-event rhetoric?

Read more: Financing for Development Conference is over, what now? – Reflections from experts

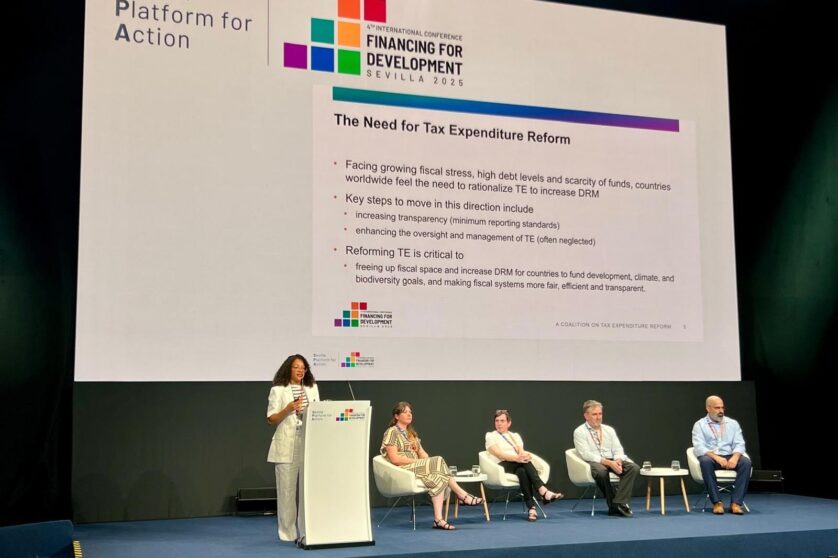

New coalition to drive reform on tax expenditures launches at FfD4 in Seville

Five leading global research and policy organisations launched a coalition to accelerate reforms of tax expenditures through evidence-based research and technical assistance on the opening day of the Fourth Financing for Development Conference (FfD4).

Building better tax capacity is a necessary condition for all aspects of sustainable development. In this policy briefing, we highlight concrete lessons on what works for smart, fairer tax reform. Aid remains critical to boost tax capacity whilst integrating research into tax administration can support evidence-based reforms and avoid failed approaches.

Read more

Taxing the wealthy in lower-income countries

One of the tools that lower-income country governments have at their disposal is particularly under-utilised – taxing the wealthy more effectively. This ICTD policy brief explains why it’s important, and how it can be done.

Study with us

Our Master’s in Governance, Development and Public Policy will help you understand how public authority is created and exercised. You’ll study topics including public finance, development in cities, and democracy and public policy.

Opinion series : The future of funding for international development

ODA cuts are undoubtedly a huge setback for international development, but also offer a moment to rethink. Our opinion series offers reflections from IDS experts.