The horticulture sector is fundamental to Kenya’s economy and its citizens’ livelihoods. However, global connectivity and high perishability make the sector vulnerable to shocks. The Covid-19 pandemic and related policy measures impacted the sector in multiple ways, with an estimated US$3m lost per day during lockdowns. In response, the state and business worked together to analyse issues and develop solutions, facilitated by digital technologies. This Policy Briefing identifies lessons from this experience, focused on the French bean and avocado sub-sectors. The aim is to build knowledge that can be applied to new opportunities and risks affecting the resilience of the horticulture sector.

Download the Policy Briefing PDF from the IDS OpenDocs repository.

Key messages

- The pandemic had a significant impact on Kenya’s horticultural sector.

- French beans faced a shortage of fresh cargo space and an escalation of challenges in responding to European phytosanitary standards. Demand rose for avocados but the pandemic exacerbated problems with the harvesting of immature avocado fruits.

- From the start of the pandemic, stronger state–business interactions enabled the sector to analyse and respond to emerging issues, facilitated by digital technologies.

- To address opportunities and risks affecting its resilience, the horticulture sector should: embrace digital technology, invest in multisectoral coordination, improve innovative financing mechanisms, support farmer access to clean planting materials for avocados, revitalise extension services, and manage changing market dynamics.

Background

Agriculture is fundamental to Kenya’s economy, and to the livelihoods of many of its citizens. The horticulture sector accounted for 24 per cent of total export earnings in 2019, overtaking tea and coffee as the top export earner. The sector’s global connectivity and high perishability, however, mean that it is vulnerable to internal and external shocks.

The Covid-19 virus and the policy measures introduced to control its health effects had significant impacts for Kenya’s horticultural sector, which lost an estimated US$3m per day during lockdowns. Measures included night-time curfews, suspension of international and domestic air travel, land border controls restricting entry, and temporary bans on movement into and out of certain areas including Nairobi, Mombasa, and Mandera. While essential services were exempt from restrictions, farming was initially not listed as an essential service. This led to delivery delays and shortages, increased costs for inputs, post-harvest losses, reduced incomes, and job losses for over 3.5 million Kenyans employed in agriculture. The decline in air freight capacity drastically undermined export volumes, resulting in layoffs and business closures. At the same time, the pandemic compounded pre-existing challenges, linked to inflation, drought, climate change, and high phytosanitary requirements, testing the resilience of the sector.

Institute of Development Studies (IDS) and the Centre for African Bio-Entrepreneurship (CABE), in collaboration with the Horticultural Crops Directorate (HCD) and the Fresh Produce Exporters Association of Kenya (FPEAK), came together under the auspices of the Covid Collective Research Platform to identify and disseminate lessons from these experiences. The project studied the interactions between value chain businesses and state actors in the horticulture sector as they sought to respond to the pandemic. The study focused on two sub-sectors with high and emerging economic importance: French beans and avocados.

In late 2021, researchers interviewed 28 stakeholders from these two value chains, including producer organisations, exporters, processors, business associations, regulators, and policymakers across Nairobi, Muran’ga, and Kirinyaga counties. These were followed in 2022 and early 2023 with consultative meetings held nationally, and in Kajiado and Bomet counties, where stakeholders reflected on the learnings from experiences during the pandemic as well as new opportunities and risks, generating recommendations for a more resilient horticulture sector.

State–business responses to the pandemic

Overall, the pandemic drove stronger state–business interactions, which were partly facilitated by the use of digital technologies. In the first days after the World Health Organization (WHO) confirmed a global pandemic, President Uhuru Kenyatta and leading businesses, represented by the Kenya Private Sector Alliance (KEPSA), came together for situation analysis and solution development. This presidential roundtable met every two weeks in the early days of the pandemic to develop an economic response framework. Although this roundtable structure had existed since 2013, it had previously only met infrequently.

With emerging impacts on food security and livelihoods, other new fora also took shape. The Ministry of Agriculture, Livestock, Fisheries and Cooperatives (MoALFC) launched the Food Security War Room (FSWR). Led by the County Government Co-ordination and Food Supply Working Group and made up of key sector ministries and the Council of Governors, the FSWR also met fortnightly for two months. Working groups tackled challenges affecting food availability, market access and input supply and food prices. The FSWR was instrumental in having agriculture declared an essential service, restoring freedom of movement for people and goods, and easing delivery of both extension services and of agricultural produce. These changes affected both domestic food security and export crops, which were recognised as important foreign exchange earners.

The Situation Room was another body, set up by the Ministry of Industrialization, Trade and Enterprise Development (MoITED) in partnership with UK Aid’s Manufacturing Africa programme. The aim was to address the economic and job impacts of the pandemic. It enabled companies and private sector associations to rapidly identify issues and conduct analyses, and in coordination with MoITED, to propose solutions to other ministries, including the Ministry of Health and MoALFC. The Situation Room even had a 24/7 hotline for enquiries and to identify key issues across the economy.

Across the different fora, many interactions happened through digital communication platforms and virtual meetings. While attendance was initially low, it became a regular way of meeting once participants became used to the format, enhancing flexibility, facilitating participation of more stakeholders, and enabling faster decision-making. Digital platforms also provided a means for faster feedback from regulators, such as on licensing and certification status.

Other digital innovations include the use of electronic certification to enhance exports of produce and imports of inputs and other production materials, and the development of a digital platform for stocktaking, established by Twiga Foods. Digital technologies continue to be used to access and disseminate information, and innovations were incorporated in the national Agricultural Marketing Strategy that was launched in 2023.

The experience in French beans during and since the pandemic

In the specific case of the French bean sub-sector, the priority was to engage government to address air freight capacity. Prior to the pandemic, French beans were exported in the hold of passenger aircraft, but flights were halted at the beginning of the pandemic. The grounding of passenger aircraft meant a drastically reduced freight capacity, high freight costs, layoffs and business closures of export companies, and delayed orders for farmers. Farmers lost income and farm workers lost livelihoods, with negative effects for the following season’s crop.

Through the FSWR and the presidential roundtable, the sub-sector secured a stimulus package for Kenya Airways to increase cargo capacity. The airline responded by modifying passenger planes to create cargo space. Exports experienced improvements, although shortages of fresh cargo space persisted throughout 2021.

During the pandemic, French bean exports to the European Union (EU), the sector’s major market, were also negatively affected by an escalation of ongoing issues related to maximum residue levels (MRLs) of agrochemicals. The escalation was attributed to an increased scrutiny of MRLs by the EU, leading to a rise in interceptions for non-compliance. On the Kenyan side, a shortage of farm workers and of adequate agrochemicals brought on by the pandemic, alongside a lack of adequate training, were also identified as contributors.

In response, state agencies and industry associations worked together to develop and implement new protocols and guidelines in a bid to increase compliance with regulatory standards. Awareness forums were held with growers and additional quality control measures were promoted by the industry. Government input grants early in the pandemic helped some farmers purchase seeds, fertiliser, and agrochemicals for the next season’s production. Electronic certification with online monitoring and documentation of products and processes was also introduced, leading to greater control of produce at farm level.

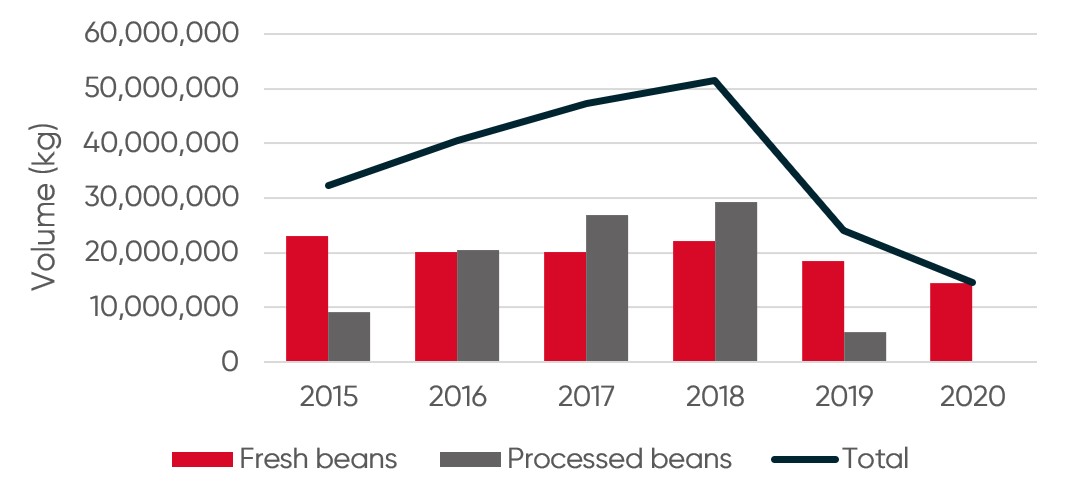

Figure 1 Export trend in French beans before and during the pandemic (2015–20)

Source: Thorpe et al. (2022), based on AFA-HCD data 2020.

New opportunities and risks

As the avocado sub-sector recovers from the effects of the Covid-19 lockdowns, it is pushing to diversify export markets. Combined government and industry efforts have secured new access to the Chinese market from August 2022, with other opportunities emerging in Malaysia and India. Regional markets are also targeted following the reinvigoration of the African Continental Free Trade Area (AfCFTA), which had been delayed by the pandemic.

However, these opportunities come at a time when the avocado sub-sector is still struggling with how to address the harvesting of immature avocado fruits, alongside a need to improve compliance with phytosanitary regulations. There is a call for enhanced traceability, with a registered list of licensed exporters and marketing agents, and better training and capacity-building of farmers. With limited government extension capacity, alternative approaches such as cooperative-led, digital agro-based or independent agribusiness advisory services have already emerged. However, problems with the authenticity of technical support and the circulation of inaccurate information need to be addressed, such as through formal quality assurance for the sector. Stronger linkages between research and extension could also play a part.

As for French beans, the avocado sub-sector has also faced sharply rising costs for inputs such as seedlings, fertilisers, traps, and crates. Alternative financing mechanisms including microfinance, savings and credit cooperatives (SACCOs), joint saving schemes, and Warehouse Receipt Systems (WRS) help address financial needs, but these are insufficient. For new sector entrants, however, the greatest challenge is access to clean planting materials. Nurseries propagating certified seedlings are not properly regulated, leaving farmers buying seedlings from unregistered operators. For example, farmers in Bomet were unknowingly planting uncertified seedlings which were not true to type. Training new operators is also required.

Policy recommendations

The Kenyan horticulture sector can build on these experiences of state–business responses to the Covid-19 pandemic, applying the learning to address current and future opportunities and risks affecting its resilience. To do so, the horticulture sector needs to:

- Embrace digital technology: the sector can maintain improved interactions through digital communication platforms, and professionally monitored technologies for electronic phytosanitary certification and decentralised field inspections.

- Invest in multisectoral coordination: the sector should continue to invest in public–private and intersectoral coordination and networks. These could be integrated as part of an early warning system for future shocks. Another opportunity is to strengthen research–extension linkages between research institutes and government extension services.

- Improve innovative financing mechanisms and strengthen policy oversight: there is a need to further strengthen financing options for the horticulture sector, including policy measures to de-risk loans and regulations against predatory lending practices.

- Support farmer access to clean planting materials for avocados: relevant measures include mapping existing avocado nurseries, creating a database of registered nurseries, and establishing new licensed nurseries.

- Revitalise extension services: farmer cooperatives need support for the appropriate use of agrochemicals or alternatives, to reduce post-harvest losses. And to build resilience to shocks. Agricultural service providers need to be retooled and better coordinated to provide a holistic approach.

- Manage new markets and changing market dynamics: the horticultural sector is opening new regional and international markets that can aid resilience. However, further work is needed to raise earnings, including through greater value addition, improved marketing, and addressing cargo freight connectivity.

Further reading

Fulano, A.M.; Lengai, G.M.W. and Muthomi, J.W. (2021) ‘Phytosanitary and Technical Quality Challenges in Export Fresh Vegetables and Strategies to Compliance with Market Requirements: Case of Smallholder Snap Beans in Kenya’, Sustainability 13.3: 1546, DOI: 10.3390/su13031546 (accessed 4 July 2023)

Gölgeci, I.; Yildiz, H.E. and Andersson, U. (2020) ‘The Rising Tensions Between Efficiency and Resilience in Global Value Chains in the Post-Covid-19 World’, Transnational Corporations 27.2: 127–41, DOI: 10.18356/99b1410f-en (accessed 4 July 2023)

Horner, R. and Alford, M. (2019) The Roles of the State in Global Value Chains: An Update and Emerging Agenda, Global Development Institute Working Paper 2019-036, Manchester: Global Development Institute, University of Manchester (accessed 4 July 2023)

Thorpe, J.; Odame, H.; Quak, E-J. and Ayele, S. (2022) Covid-19: Shaping the Nexus between State–Business Relations and Global Value Chains: The Case of Horticulture in Kenya, Brighton: Institute of Development Studies (accessed 4 July 2023)

Credits

We would particularly like to pay tribute to the hard work and insightful contributions made by Hannington Odame, who sadly passed away a few days before the publication of this briefing.

This IDS Policy Briefing was written by Jodie Thorpe (IDS), Hannington Odame (CABE), and Elosy Kangai (independent consultant). It was funded by the UK government’s Foreign, Commonwealth & Development Office (FCDO) through the Covid Collective Research Platform. Covid Collective cannot be held responsible for errors, omissions, or any consequences arising from the use of information contained. Any views and opinions expressed do not necessarily reflect those of FCDO, Covid Collective, IDS or any other contributing organisation. We acknowledge the regulatory contributions to this work from Josephine Simiyu from HCD, the insights on experiences of business associations from Anthony Mutiso of FPEAK, and on media perspectives from Bernadine Matanu, a consulting journalist.

© Institute of Development Studies 2023. © Crown Copyright 2023. This briefing is licensed for non-commercial purposes only. Except where otherwise stated, it is licensed for non-commercial purposes under the terms of the Open Government Licence v3.0.