At the table, off the menu? A virtual roundtable discussion on deepening the inclusiveness of global tax negotiations. Since 2013, the formal structure of global corporate tax policymaking has changed. Decisions are no longer made by 37 OECD members, but by 137 countries from all regions and levels of development through the OECD/G20 ‘Inclusive Framework’ (IF) on Base Erosion and Profit-Shifting (BEPS). Official documentation emphasises that all countries participate on an ‘equal footing’, but some participants and observers have emphasised that developing countries in particular face practical obstacles that lead to unequal participation in practice.

During the last year, the ICTD has been studying the experiences of lower-income countries in global tax negotiations. This event marks the launch of a working paper based on interviews with 48 stakeholders, most of them current or former participants in IF decision-making. The ICTD’s research explores lower-income countries’ achievements in negotiations since the BEPS process began, develops a typology of mechanisms of influence, and suggests recommendations for strengthening them.

Join us to learn about the research findings and hear reflections from a panel of tax negotiators from lower-income countries. The event will be held on Zoom, with simultaneous translation between English, French, and Spanish. Register in advance to receive the Zoom invitation link to join online.

Programme:

13:00 -13:05 Introduction

13:05 – 13:30 Research presentation

13:30 – 13:45 Q&A with authors Dr Tovony Randriamanalina and Dr Martin Hearson

13:45 – 14:30 Roundtable discussion with panel:

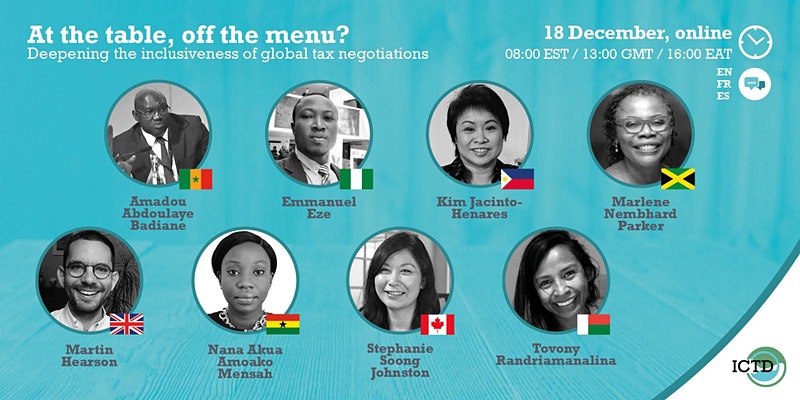

- Amadou Abdoulaye Badiane, Director of Legislation and International Co-operation, Directorate General of Taxes and Customs, Senegal

- Emmanuel Eze, Manager, Tax Policy and Advisory Department, Federal Inland Revenue Service, Nigeria

- Kim Jacinto-Henares, Senior Advisor, Albright Stonebridge Group, former Commissioner, Bureau of Internal Revenue, Philippines, and member of the UN Tax Committee

- Marlene Nembhard Parker, Chief Tax Counsel for Legislation, Treaties and International Tax Matters, Tax Administration Jamaica, member of the Inclusive Framework steering group and the UN Tax Committee

- Nana Akua Amoako Mensah, Legal Officer and Competent Authority for exchange of information, Ghana Revenue Authority

Moderated by Stephanie Soong Johnston, chief correspondent, Tax Notes Today International.

About the ICTD

The International Centre for Tax and Development is a global policy research network, devoted to improving the quality of tax policy and administration in developing countries, with a special focus on sub-Saharan Africa. Find out more: www.ictd.ac

Timezones

This virtual roundtable will be happening at 13:00-14:30 UK time. For other time zones:

08:00-09:30 in Washington D.C. US

13:00-14:30 in Accra, Ghana

14:00-15:30 in Abuja, Nigeria

16:00-17:30 in Addis Ababa, Ethiopia

21:00-22:30 in Beijing, China

See this link to find out what time the event is happening in your time zone.